Our business philosophy helps you enrich your business

India being one of the most accelerating countries in the world comprises of colossal human resources and a pool of diversified potential customers. Sighting this huge market, foreign direct investments (FDIs) are lured to set up business here, resulting in a gigantic influx of FDI in the country every year.

One such source of FDI is foreign companies setting up their business operations in India. Contemplating this to be the fuel in the process of moving India to a more developed nation, government of India has flexed the restrictions to a greater extent, thus, enabling the infusion of more foreign investments in the economy.

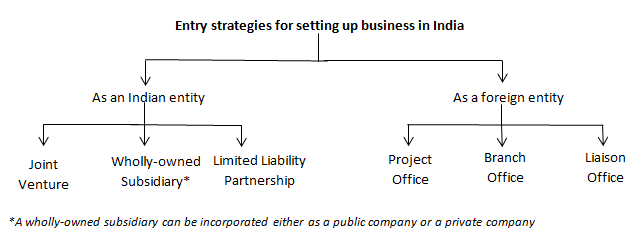

Establishing an Indian entity

To incorporate an Indian entity in form of a joint venture or a wholly-owned subsidiary, a company has to be incorporated under Companies Act, 2013 or any other Act for the time being in force:

» Setting up a Joint venture with an Indian partner i.e., undertaking a commercial enterprise jointly by two or more parties with the view of carrying out a particular project, which otherwise retain their distinct identities.

» Forming a Wholly-Owned Subsidiary i.e., establishing a company whose common stock is 100% owned by a parent company, in sectors which permit 100% FDI through the FDI policy formulated by Department of Industrial Policy and Promotion (DIPP). Subject to equity caps provided in the FDI policy concerning the various areas of activity and depending on the investor’s decision, 100% foreign equity in such Indian companies is permissible.

Application with the Registrar of Companies (ROC) has to be made for registration and incorporation of a company. Once such a company has been incorporated and duly registered as an Indian company, it is subject to Indian law and regulations as appropriate to all other domestic Indian companies.Apart from incorporating a company, one can also choose to incorporate a limited liability partnership to establish a business in India:

» A Limited Liability Partnership (LLP) is a new form of business structure in India that integrates the benefits of a company with the advantages of organizational flexibility associated with a partnership. The FDI policy for LLPs has been notified lately making this a feasible entity form for foreign investors to establish their business operations in India.

Establishing a Foreign Company

Prior approval from RBI and / or government is required for setting a business venture in India by virtue of a Liaison Office / Project Office / Branch Office. Also, the condition to open a branch office / project office / liaison office is that one has to be a foreign body corporate, limits the scope for any foreign national i.e. a proprietary concern or a partnership firm to expand autonomously and capture a significant market share. In other words, only a body corporate incorporated outside India can incorporate any of these offices.

1. A liaison office ,also known as representative office facilitates communication between headquarters or principle place of business in India and the offshore entities in India. Information is collected about business opportunities in the present market and the same are made available by the parent company and its products to prospective clients in the region. However, the office can not undertake any commercial activity directly or indirectly and therefore, cannot have any income / earnings in India. Following activities are allowed to liaison office in India:

» Representation of parent company / group companies in India;

» Promoting export from or import to India;

» Collection of information about possible market opportunities, source of supply, providing information about parent company and its products to the prospective Indian customers or vice versa to its vendor;

» Promoting technical or financial collaboration between parent company / group companies / other companies established in India; or

» Acting as a communication channel between parent company and companies registered in India.

Envisioning the execution of certain projects in India, foreign companies set up certain temporary offices / site offices, they are generally called as project office. RBI has granted certain permissions to foreign companies for setting up of project offices, subject to certain conditions. The offices may abrogate any surplus funds outside India once the project gets completed, consent for which has been granted by RBI. However, these offices cannot deviate and take steps or perform activities other than those related to the project for the purpose of which such office was set up. RBI has granted general permission to foreign companies to establish project offices in India, provided they have secured a contract from an Indian company to execute a project in India, and

» The project is funded directly by inward remittance from abroad;

» The project is funded by a bilateral or multilateral International Financing Agency;

» The project has been cleared by an appropriate authority; or

» A company or entity in India awarding the contract has been granted term loan by a public financial institution or a bank in India for the project.

2. A branch office of a foreign company can carry out manufacturing and trading activities abroad and are established in the region / market of manufacture for the following purposes:

» Import / export of goods / merchandise of raw material and finished product;

» To bring about better technical / financial collaborations between Indian companies and the parent or overseas group company;

» Providing consultancy, advisory or professional services;

» Supplementing research work and experimentation, in which the parent company is engaged, making it more economical;

» Catering to software development and Information Technology services;

» Authorized buying / selling agents in India for the parent company; or

» Providing technical support to the products coming from the parent / group companies and troubleshooting any local issues.

Manufacturing activities have certain restrictions as a branch office is not permitted to carry out manufacturing activities by itself but is prescribed to sub-contract these to an Indian manufacturer. The profit of the branch may be remitted outside India for branch offices subject to the approval from RBI. The remittance is net of applicable Indian taxes and subject to RBI guidelines.